US Home Resales soar 7.2 percent in July

WASHINGTON (AP) — The U.S. housing market is rebounding faster than expected.

Home resales in July posted the largest monthly increase in at least 10 years as first-time buyers rushed to take advantage of a tax credit that expires this fall. Sales jumped 7.2 percent and beat expectations, according to the National Association of Realtors.

"The housing market is back up and running and that is great news," wrote Joel Naroff of Naroff Economic Advisors.

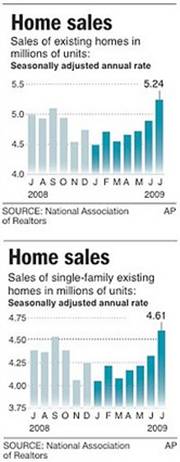

Sales hit a seasonally adjusted annual rate of 5.24 million in July, from a pace of 4.89 million in June. It was the fourth-straight monthly increase and the strongest month since August 2007. Sales had been expected to rise to an annual pace of 5 million, according to economists surveyed by Thomson Reuters.

The risks, however, are unemployment, mortgage rates, and a homebuyer tax credit that is over at the end of November. And the last one could be a doozy because first-time buyers are snapping up one out of every three homes.

First-time buyers get a credit of 10 percent of the purchase price of a home, up to $8,000. Singles must earn less than $75,000, and couples less than $150,000. The real estate industry is lobbying to have the credit extended, but its unclear if Congress will be swayed.

The home sales report was another sign that the U.S. economy is on the verge of a long-awaited recovery after enduring a brutal recession and the worst financial crisis since the Great Depression.

Economic activity in both the U.S. and around the world appears to be leveling out and "the prospects for a return to growth in the near term appear good," Federal Reserve Chairman Ben Bernanke said Friday.

But fallout from the recession will linger for some time. Unemployment rose in July in 26 states and fell in 17, the Labor Department said Friday. That is driving up foreclosures, which are not expected to level off until sometime next year.

Sales of foreclosures and other distressed properties made up about a third of all transactions last month, down from nearly half earlier this year. In places like San Diego and Orlando, buyers are snapping up foreclosed properties at deep discounts, and real estate agents are pressing banks to release more foreclosures onto the market.

The inventory of unsold homes on the market rose to 4.1 million, from 3.8 million a month earlier as buyers who had held their homes off the market in the past decided to list them for sale. That's a 9.4-month supply at the current sales pace, unchanged from June.

AP Real Estate Writer Adrian Sainz contributed to this report. AP Economics Writer Jeannine Aversa contributed reporting from Jackson Hole, Wyoming.