County housing market strengthening

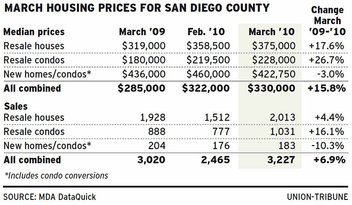

By Roger Showley, UNION-TRIBUNE STAFF WRITER SAN DIEGO — San Diego County’s housing market shook off its winter doldrums and turned in a March median that suggests prices have firmed up and may be heading upward, MDA DataQuick figures showed Monday. The local firm that tracks the real estate market reported the March median at $330,000, equal to December’s level. It was $45,000, or 15.8 percent, higher than in March 2009 — the biggest percentage increase in five years — and up $8,000, or 2.5 percent, from February. DataQuick analyst Andrew LePage said the rise is mainly because of more higher-cost homes selling instead of a general rise in appreciation. Homes selling for more than $400,000 comprised 37.4 percent of the March market, up from 34.1 percent in February and 26.9 percent in March 2008. At the same time, homes selling for less than $300,000 accounted for 42.3 percent of the market, down from 43.6 percent in February and 52.6 percent a year ago. “It’s price softness in the high-end that is driving sales and bringing up the high-end total contribution to countywide sales,” LePage said. He and other analysts said the future of the housing market, still emerging from a five-year slide, will turn on interest rates and low-cost distress sales. Foreclosure sales dropped in March after rising the previous three months, normally a sign of less distress. But LePage said lenders likely switched their attention to short sales — homes sold for less than the mortgage balance — instead of facing higher losses by sending properties through the foreclosure process. The market share of foreclosure resales was 32.8 percent, down from 38.7 percent in February. Still, University of San Diego economist Alan Gin said he is optimistic about the housing market because the economy looks more promising. “The economy is starting to rebound,” Gin said, “so the question is, can the economy rebound fast enough to save people from these foreclosures? Can enough new jobs be generated so people who are stressed out can find work and meet their mortgages? I think that’s going to be the conflict through much of 2010. Some people might be saved; others will not.” DataQuick said sales totaled 3,227 in March, up 30.9 percent in the usual upturn from February but 18 percent below the March average going back to 1988. Real estate agents say sales are down from normal levels because inventories are relatively low, as many would-be sellers wait for prices to rise. At the neighborhood level, DataQuick reported declining median prices for resale houses in high-priced neighborhoods, while prices in the lowest-priced ZIP codes rose. Among neighborhoods with at least 20 resales in the first quarter, the median price in Rancho Santa Fe was down 72.2 percent from $6.5 million in the first quarter of 2009 to $1.8 million this past quarter. La Jolla, Del Mar, Solana Beach and Coronado quarterly medians also were down year-over-year. Logan Heights rose 4.4 percent to $135,750, as did other low-cost places such as Golden Hill, National City and City Heights. Rich Toscano, a real estate market watcher at Pacific Capital Associates, said another measurement of price changes, cost per square foot, rose about 5 percent from February to March, double the median increase of 2.5 percent. He said that indicates a rise in value. “I have a feeling that we are in a recovery of sorts,” Toscano said. But, he cautioned, “I definitely have concerns about the sustainability of the recovery.” Most worrisome to Toscano and others is the outlook for interest rates. Last week, the Mortgage Bankers Association reported an average rate for 30-year fixed-rate mortgages of 5.31 percent, up from 5.04 percent the week before. Some economists believe that rate could reach 6 percent by the year’s end. Would-be homebuyers have to decide whether it’s worth hoping for lower prices, when higher rates could eliminate any savings on the monthly payment. Dave McDonald, a mortgage broker at American Dream Real Estate Group, said for every 1 percentage point increase in mortgage rates, the purchase price would have to drop roughly 10 percent to yield the same monthly payment. For example, a loan of $330,000 at 4 3⁄8 percent, available two weeks ago, would have to drop to $295,000 to produce the same monthly payment of about $1,750 at 53⁄8 percent. “If you could find something you like and could qualify, I’d say buy it,” McDonald said. |